We know from experience that within the Oil, Gas, and Petrochemical (OGP) business, control and safety systems play a vital part of the safe and effective operation of a plant. Over the years, this has resulted in a situation where OEMs almost have a monopoly for the sourcing of hardware and support services for supporting these vital and complex systems. However, there are alternative sourcing options for these control and safety systems.

Why is this important? The purchasing departments will certainly claim that competition is good to maintain fair prices and good support. There might even be situations or projects where independence is important to ensure the best technical solutions, without being tied to only one system. Sourcing multiple systema from the same source may also reduce the number of interfaces and could be beneficial in both project and operational phases.

Channel partner programmes for control and safety systems

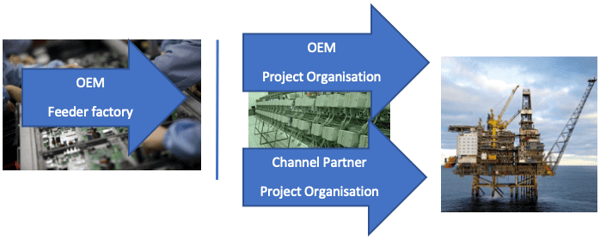

All control and safety system OEMs (Original Equipment Manufacturer) or system suppliers will be looking for ways to sell as much as possible to keep prices low and competitive. Feeder factories need volume, and consequently establish different channels to the end users. Most OEMs will also have their own separate channels to the market, through projects or other sales organisations.

The use of alternative suppliers is currently utilised to different degrees by the OEMs. Siemens, as an example, has established a huge Channel Partner organisation with more than 1000 individual organisations employing over 11,000 individuals. However, different OEMs use different branding of their partner programs so you may come across terms like:

- System Integrator – vendor agnostic resells the solutions as a part of an overall solution

- Value Partner

- Authorised Value Provider

- Solution provider – actively promotes the solution loyal to the OEM

- Channel Partner

The terms are used differently, and the programmes are managed differently from each OEM, but generally the above terms differ from a distributor that only resells the product as-is and is normally 80-90% products based, to a Channel Partners that always adds value to the product before it is being sold to the end-user.

Common for most programmes is:

- Approval process for the partner performed by the OEM covering technical expertise and economical solidity.

- Partner has to adhere to certain standards (Example: ethical guidelines, HSE standards).

- OEMs will guarantee in-depth product support to the partner.

- Warranty of the components.

- No communication to OEMs project organisation.

Why is most modification and support delivered by the OEM within OGP?

Different industries use channel partners differently. The Oil, Gas, and Petrochemical industry is advanced with major development projects where the strongest OEMs deliver huge integrated solutions. This demands a big and capable delivery organisation, which is normally outside the capabilities of most channel partners and system integrators, as these are usually smaller independent companies. Some specialised package suppliers still base their control systems on channel partners or even supply it themselves, but these packages are small parts of the lager systems. After winning a hugely competitive new project, the OEMs project organisations will try to maintain the customer relations and will hopefully be supporting their end users in a less competitive environment. Having an organisation adapted to huge competitive delivery projects motivated to regain revenues is maybe not the best setting for the end users.

Benefits of for the end user:

The challenge on complex ICSS systems is to find product specialists. The use of channel partners is one source of finding these experts. There are a number of benefits, including:

- Introducing competition and ensuring competitive pricing.

- May have simple delivery models fit for purpose (E.g. Modifications).

- Mitigating risk with limited number of experts available.

- Reducing number of interfaces from system integrators with multiple product brands supported.

- May have specialised domain knowledge (E.g. alarm systems, compressor control, metering systems).

- Business driver to keep project small (large projects are often not feasible for small channel partners).

- Channel partners are more vendor agnostic and independent from selling “own” solutions for more optimised solutions.

- Larger drive for OEM personnel to learn "new and hot" technology instead.

More competition in the after-sales phase will improve services and give end-users a choice. Is this the time for you to consider alternative sources for modification or product support?